How to calculate margin (collateral) in the MetaTrader platform? How to determine leverage by instrument?

It should first be noted that margin requirements are expressed as a percentage in the MetaTrader's trading conditions. This is the percentage of a transaction's nominal value that will be set aside as the margin.

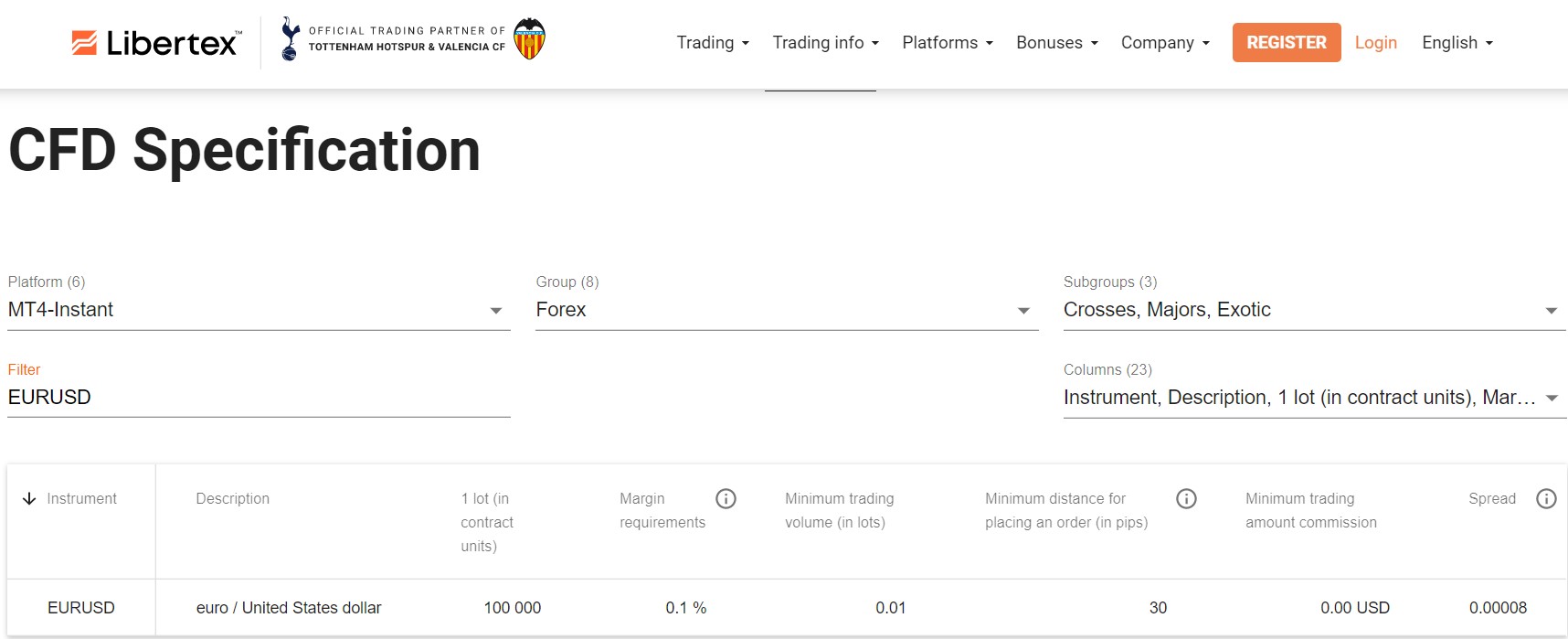

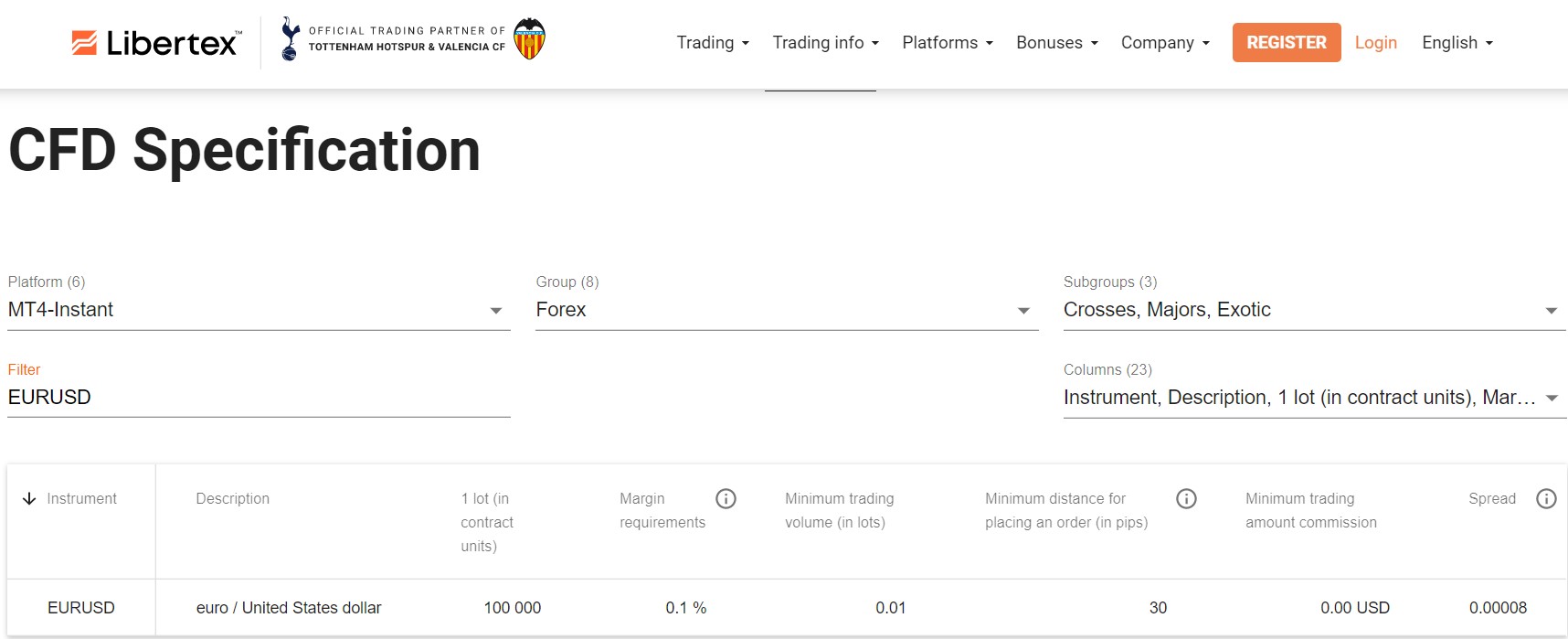

For example, for EURUSD, the margin requirement is 0.1% (information on each instrument's trading conditions is available in the Instrument Specification).

This is the percentage of the transaction's nominal value that will be held on the account as margin.

Let's look at a calculation example for this instrument.

Let's assume that we're planning to open a transaction on EURUSD at 1.18250 with a volume of 1 lot.

One lot corresponds to 100,000 units of the base currency.

Thus, the transaction's nominal value is:

1.18250 (opening price) * 100,000 (transaction volume) = $118,250

Only 0.1% of this amount, i.e., $118.25, will be reserved as margin.

How to determine the maximum leverage by instrument?

If necessary, the margin requirement as a percentage can be expressed in a form that many traders find familiar.

To do so, divide the margin requirement in percentage by 100.

In other words, the leverage for EURUSD is 100/0.1 = 1000. So, as a fraction, the leverage is 1/1000.

Several formulas for calculating the margin for different types of trading instruments are shown below:

For directly priced pairs like EURUSD and GBPUSD:

Collateral = Current Price * Volume/Leverage

For reverse priced pairs like USDRUB and USDJPY:

Collateral = Volume/Leverage

For cross rates like EURRUB and EURJPY:

Collateral = Current Price * Volume/Leverage/Price of currency being quoted

Calculating margin for stocks and indices:

Margin requirements in % * volume of shares * instrument volume = margin for an open position

It should first be noted that margin requirements are expressed as a percentage in the MetaTrader's trading conditions. This is the percentage of a transaction's nominal value that will be set aside as the margin.

For example, for EURUSD, the margin requirement is 0.1% (information on each instrument's trading conditions is available in the Instrument Specification).

This is the percentage of the transaction's nominal value that will be held on the account as margin.

Let's look at a calculation example for this instrument.

Let's assume that we're planning to open a transaction on EURUSD at 1.18250 with a volume of 1 lot.

One lot corresponds to 100,000 units of the base currency.

Thus, the transaction's nominal value is:

1.18250 (opening price) * 100,000 (transaction volume) = $118,250

Only 0.1% of this amount, i.e., $118.25, will be reserved as margin.

How to determine the maximum leverage by instrument?

If necessary, the margin requirement as a percentage can be expressed in a form that many traders find familiar.

To do so, divide the margin requirement in percentage by 100.

In other words, the leverage for EURUSD is 100/0.1 = 1000. So, as a fraction, the leverage is 1/1000.

Several formulas for calculating the margin for different types of trading instruments are shown below:

For directly priced pairs like EURUSD and GBPUSD:

Collateral = Current Price * Volume/Leverage

For reverse priced pairs like USDRUB and USDJPY:

Collateral = Volume/Leverage

For cross rates like EURRUB and EURJPY:

Collateral = Current Price * Volume/Leverage/Price of currency being quoted

Calculating margin for stocks and indices:

Margin requirements in % * volume of shares * instrument volume = margin for an open position